Big Changes to Tax Forms & 1099 Reporting This Year

You know Altec as the company that helps businesses go paperless and automate processes with DocLink, our industry-leading document management solution. But what if we told you we started by selling paper business forms? AND that we continue selling printed documents today?

In the world of going paperless, companies of all sizes still have the need for specific paper documents. Paper checks are still convenient and necessary for companies whose employees may not have access to online services. And federal forms, such as tax forms, remain essential paper documents for the same reasons.

Altec was originally founded as a business arm of Platinum Software, now Epicor. Customers utilizing Platinum’s burgeoning accounting software would ask where to get the proper accounting forms so it was a natural progression. The forms division was named Altec Products and eventually spun off as its own company. Altec then acquired software company Brookhollow based in Tacoma, WA, where our DocLink product development group remains.

Don Howren, Altec’s President and COO states, “Our primary business focus is on helping companies make a digital transformation and eliminate paper with DocLink. But many companies still want or need to use certain paper products, particularly checks and tax forms. We have customers ordering forms who have been with us for decades.”

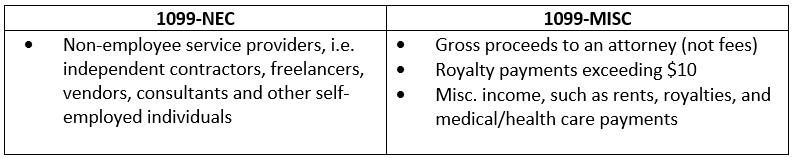

Altec’s forms department is constantly busy supporting over 13,000 customers, but at this time of year they’re focused on providing them with their necessary tax forms. The team has been educating clients about the major change the IRS made for 2020 tax reporting from the 1099-MISC form to the 1099-NEC.

Essentially, the 1099-NEC doesn’t replace the 1099-MISC but separates out what is reported for each. Companies will need to use a 1099-NEC for the following four payment conditions:

- It is made to someone who is not your employee.

- It is made for services in the course of your trade or business.

- It was made to an individual, partnership, estate, or, in some cases, a corporation.

- Payments were $600 or more for the calendar year.

Whitney Lewis, Altec’s Director of Print Sales comments, “As we began contacting our customers about their 2020 tax form orders, most of them were not aware of the new form. They were grateful for our reaching out and educating them. But this is a pretty typical response from our customers. What makes Altec so unique in this industry is our proactive customer service. We hear from our customers constantly that they depend on our proactive contact to review their inventory, ensuring they have the checks and forms they need when they need them.”

Don adds, “Honestly, it’s a win-win for many companies to work with us across the spectrum. It’s a symbiotic business cross-over and many of our customers benefit from using us for both. The level of service our forms division offers is incomparable and our DocLink customers, and any business really, would benefit from their support.”

If you would like information about ordering tax forms or other products from Altec, please contact our team at 800-997-9921 or printsales@doclink.beyond.ai.